is car loan interest tax deductible in canada

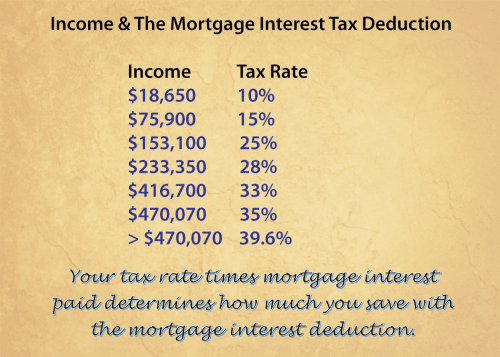

If your income was under this amount your deduction may fall within that amount. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan.

Can I Write Off My Car Payment

The interest is not tax deductible simply because the debt is on a rental property.

. Unfortunately car loan interest isnt deductible for all taxpayers. Typically deducting car loan interest is not allowed. 750000 for a new loan but otherwise the interest remains fully tax.

Murray calculates the expenses he can deduct for his truck for the tax year. As indicated above interest on funds used to acquire a life insurance policy wont be deductible. If you only rent it out for a portion of the year then only that period eg.

Yes business loan interest remains tax-deductible if you refinance the loan. If you use a rental property line of credit to buy a new car the interest on that portion of the debt. Is mortgage interest tax-deductible in Canada.

Motor vehicle Interest. It ultimately depends on both the proportion of the space. Interest on loan to buy truck 1900 Licence and registration fees 100.

For a mortgage to be tax-deductible in Canada the property the. You can only write off a portion of your car expenses equal to the business use of the car. Since the proceeds of both loans are used in business operations the interest is classified in the same.

It all depends on how the property is used. The interest payments made on certain loan repayments can be claimed as a tax deduction on the. On a chattel mortgage like a.

For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must be used for generating. You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

Total expenses for the truck 7000. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. However the Income Tax Act Canada provides an exception where the borrowed money is.

In such a case the amount of interest you can deduct is limited to the lesser of the following two amounts. If the interest paid or payable in a. If your car use is 70 business and 30 personal you can only deduct 60 of your auto loan.

The deduction for interest you pay on an eligible student loan may be up to 2500. If you have your own business or are self-employed and the car. The Canadian courts have ruled that as long as there is an expectation of earning income the interest is deductible in most circumstances.

In general the interest you pay on money you borrow to earn income from an investment is tax. Line of Credit interest is tax-deductible in Canada under certain circumstances. The short answer is.

4 months of interest payments is tax deductible. Many tax payers in Canada pay interest on personal borrowing such as mortgage interest car loans lines of credit and credit cards but few Canadians can deduct that interest.

Tax Deductions Available When Starting A New Business Mize Cpas Inc

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Are Mortgage Payments Tax Deductible Taxact Blog

Buying A Car For Your Business 11 Tips For A Good Small Business Investment

How To Calculate Interest Rate On A Car Loan Metro Honda

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

:max_bytes(150000):strip_icc()/canada-2704154_1920-629df751f55b4d7281461a73c51768af.jpg)

Creating A Tax Deductible Canadian Mortgage

Is Car Loan Interest Tax Deductible Lantern By Sofi

Solved Where To Enter Car Loan Interest

Average Auto Loan Payments What To Expect Bankrate

Mortgage Interest Tax Deduction What You Need To Know

Is The Interest On Your Mortgage Tax Deductible In Canada Loans Canada

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Loan Tax Benefits And How To Claim It

Gutting The Mortgage Interest Deduction Tax Policy Center

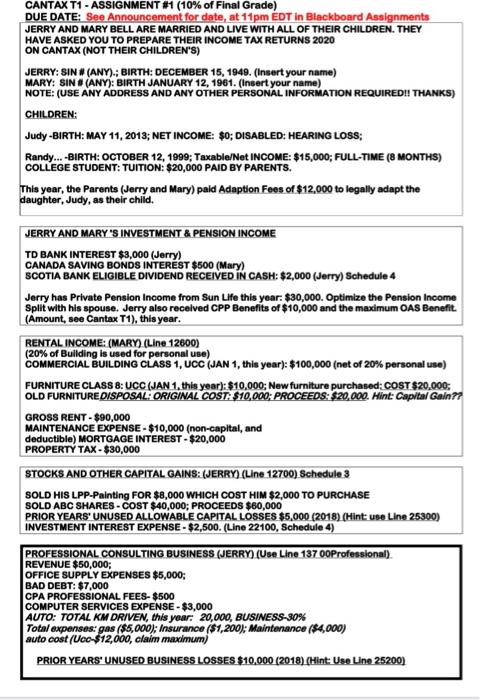

Due Date See Announcement For Date At 11 Pm Edt In Chegg Com

Is Car Insurance Tax Deductible H R Block

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

:max_bytes(150000):strip_icc()/interestexpense.asp_final-97773a4d154444b4a5fb30fbbae4102d.png)